How Quantum Computing Benefits Financial Services [2025]

2025.02.19 · Blog

Quantum Computers: How Quantum Computing Could Benefit Finance

The financial services industry is poised to be one of the first to experience the disruptive impact of quantum computing. According to McKinsey, finance is expected to be among the top industries that will benefit from quantum technology.

This article explores how quantum computing could benefit the financial services industry, offering unprecedented opportunities for trade optimization, risk management, fraud detection, customer analytics, and more.

1. Quantum Computing in Optimizing Portfolio Management

One of the most exciting applications of quantum computing in finance is the optimization of investment portfolios. Portfolio management involves selecting a mix of assets that maximizes returns while minimizing risk.

Classical computers can struggle to process the vast number of variables involved in optimizing portfolios, especially when dealing with large amounts of data or complex financial instruments.

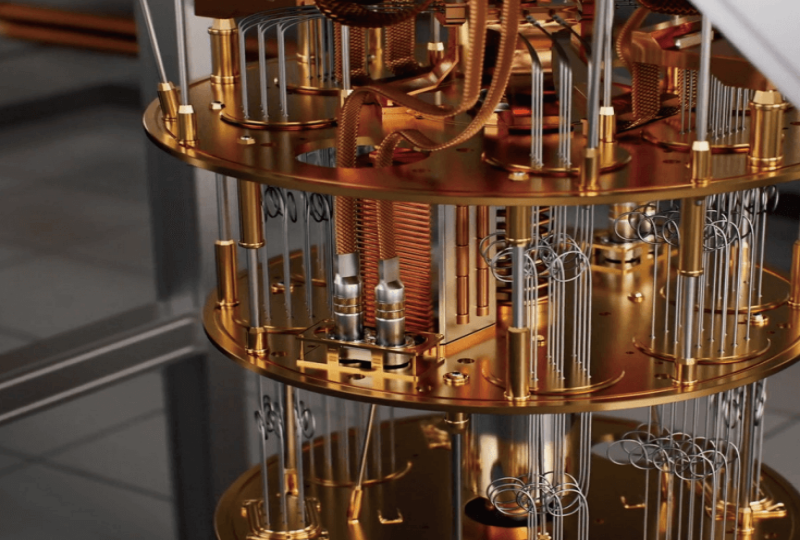

Quantum computers, however, are capable of performing these calculations exponentially faster, thanks to their ability to analyze multiple potential solutions simultaneously using quantum bits (qubits).

Quantum algorithms like the Quantum Approximate Optimization Algorithm (QAOA) and the Quantum Monte Carlo method could dramatically improve the efficiency of portfolio optimization by finding t

Real-World Successes of Quantum Computing in Portfolio Management Optimization

A notable example is JPMorgan Chase, which has been utilizing quantum computing to optimize its investment portfolio management. The bank replaced traditional Monte Carlo simulations with quantum algorithms, significantly speeding up the process of portfolio optimization. By leveraging quantum computing, JPMorgan Chase aims to improve the accuracy and efficiency of its investment strategies, offering better returns with lower risk.

2. Quantum Computing in Operational Optimization

Quantum computing can significantly optimize operations in the financial services industry by reducing costs and improving efficiency. Traditional computers often struggle to handle the complexity and volume of data needed to make optimal decisions about resource allocation and operational management.

Quantum computers, on the other hand, can process large datasets much faster and more accurately, enabling financial institutions to identify the best solutions quickly.

By leveraging quantum computing, banks and financial institutions can streamline operations, improve decision-making, and ultimately enhance resource management, leading to reduced operational costs and increased efficiency.

Success Case: SpinQ and Huaxia Bank's ATM Optimization

Huaxia Bank's subsidiary, LongYingZhiDa Fintech, worked with SpinQ to develop a quantum neural network algorithmic model to optimize ATM placement and management.

By analyzing data from 2,243 ATMs across China, the quantum AI model predicted which ATMs should be reduced based on factors such as usage trends, failure rates, and replenishment timing. The quantum neural network, implemented on SpinQ's proprietary nuclear magnetic quantum computer, delivered results with a 99% accuracy rate, outperforming classical algorithms in both speed and precision.

This quantum-based optimization is a great example of how quantum computing can enhance decision-making in the financial sector by improving operational efficiency and supporting digital transformation efforts. The results of this collaboration have been successfully implemented across all of Huaxia Bank's branches

3. Quantum Computing in Enhancing Risk Analysis and Management

Key Points:

1. Improved Risk Simulations: Quantum computing enables more accurate models of market behavior and risk scenarios.

2. Better Credit Scoring: Quantum algorithms lead to more accurate and fairer credit assessments, reducing the risk of defaults.

3. Stronger Risk Management: Quantum-enhanced models provide better decision-making and protection against market fluctuations.

Risk management is essential in the financial services industry, especially in areas like insurance, banking, and investment management.

Traditional risk models rely heavily on historical data and mathematical frameworks, but they often fail to capture all variables influencing outcomes. Classical computing struggles to handle large datasets, leading to less accurate predictions.

Quantum computing offers a breakthrough by enabling more precise simulations of financial markets and risk scenarios. Unlike classical systems, quantum computers can process vast datasets simultaneously, leading to better models of market behavior. This capability is especially important for predicting potential downturns, stress testing, and understanding complex financial instruments like derivatives and collateralized debt obligations (CDOs).

In addition to market risk simulations, quantum computing can also enhance credit scoring, a key aspect of risk management. Traditional credit scoring models often overlook important variables or fail to capture complex patterns in customer behavior. Quantum algorithms, however, can analyze larger, more diverse datasets, resulting in more accurate credit assessments. This leads to more informed lending decisions, and reduced defaults.

4. Quantum Computing in Improving Fraud Detection and Security

In an era where cyber threats are constantly evolving, fraud detection and financial security have become top priorities for financial institutions. Classical systems often rely on pattern recognition and anomaly detection algorithms, which, while effective, can be outpaced by increasingly sophisticated methods of fraud.

Quantum computing offers the potential to significantly enhance fraud detection systems by processing and analyzing large datasets in real-time with higher accuracy.

Quantum algorithms, such as Grover's search algorithm, could help identify fraudulent transactions or suspicious activities much faster than traditional systems.

Quantum cryptography, particularly quantum key distribution (QKD), offers the promise of highly secure communication systems that are immune to cyber-attacks. By leveraging quantum technologies, financial institutions could create ultra-secure systems for transactions, preventing unauthorized access and reducing the risk of cybercrime.

5. Quantum Computing in Speeding Up Financial Modeling and Simulations

Financial institutions rely heavily on complex mathematical models and simulations to predict market movements, evaluate investment opportunities, and assess the potential impact of various economic factors. These simulations can take a long time to run on classical computers, particularly when large-scale scenarios are considered.

Quantum computing could speed up these processes dramatically. By leveraging quantum algorithms for simulations, financial firms could run sophisticated models in much shorter time frames. For example, quantum-enhanced models could simulate the effect of interest rate changes or economic shocks on a portfolio in real-time, allowing traders and analysts to make faster, data-driven decisions.

This could not only provide a competitive edge for firms but also help them better navigate uncertain markets, reducing the time lag between data acquisition and actionable insights.

6. Quantum Computing in Fostering Innovation in Financial Products

The power of quantum computing could foster innovation in financial products, creating opportunities for entirely new types of services. For example, quantum algorithms could be used to design complex financial derivatives or customized insurance policies based on real-time data analysis.

The ability to simulate a vast array of potential outcomes quickly and accurately would open new avenues for creating tailored financial products that cater to the specific needs of individual clients or institutional investors.

Furthermore, quantum machine learning could lead to the development of highly personalized financial advice and robo-advisors that take into account a greater number of factors when recommending investments, savings plans, or insurance policies.

Conclusion

Quantum computing holds immense promise for transforming the financial services industry. From optimizing portfolios and enhancing risk management to improving fraud detection and security, the potential applications are vast.

While the technology is still in its early stages, financial institutions are already exploring how they can leverage quantum computing to gain a competitive edge, improve operational efficiency, and create innovative products and services.

As quantum computing continues to mature, the financial services sector is poised to benefit from a new era of speed, accuracy, and computational power that will reshape the way financial markets operate.

Featured Content

Popular Reads

.png)